what is suta tax rate

A Contribution Rate Notice Form UC-657 is mailed to employers at the end of each calendar year and shows the contribution rate effective for the coming calendar year. In the case of the state unemployment tax this is a deduction made by employers.

Reducing Unemployment Insurance Costs Ui Suta

State Unemployment Tax Act is also known as SUTA state unemployment insurance and SUI.

. The worst positive-rate class was assigned a tax rate of 691 percent resulting in a tax of 32131 when multiplied by the 46500 wage base. The tax rate shown on the Unemployment Tax Rate Assignment Form becomes final unless protested in writing prior to May 1 of the following year. The Iowa law stipulates that UI taxes may be collected from employers under eight different tax rate tables and each tax rate table has 21 rate.

What are the state tax rates for Suta. And while some states have a range of state unemployment tax rates employers receive an assessment or tax rate which they are required to pay. Tax rates for the second quarter range from 01 to 17 for positive.

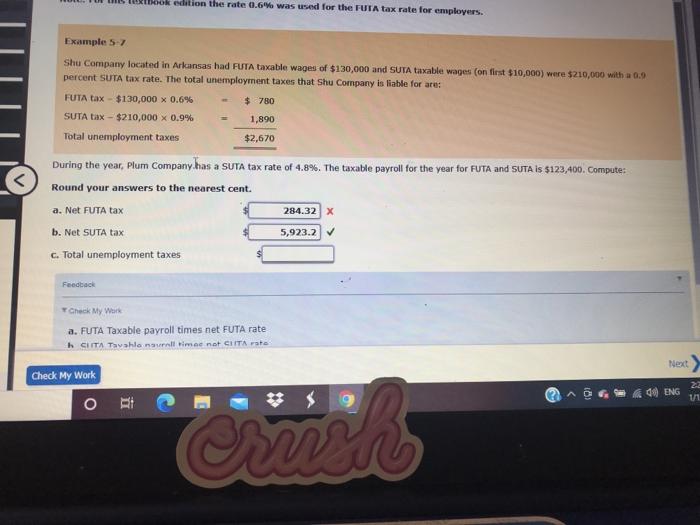

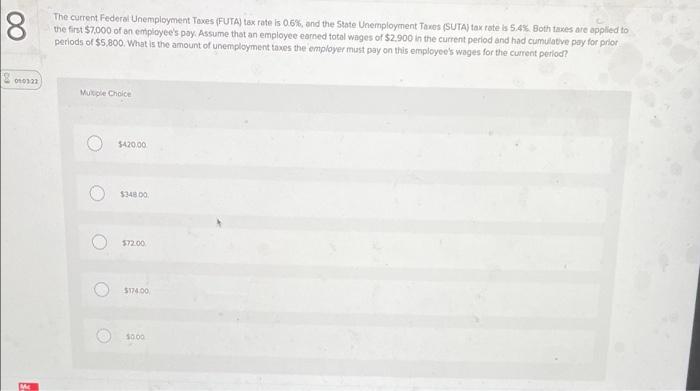

The SUTA tax program was developed in each state in tandem with the Federal Unemployment Tax Act FUTA which was established in 1939 after the US. State taxes vary including the State Unemployment Tax Act SUTA contribution rates. The best negative-rate class was assigned a rate of.

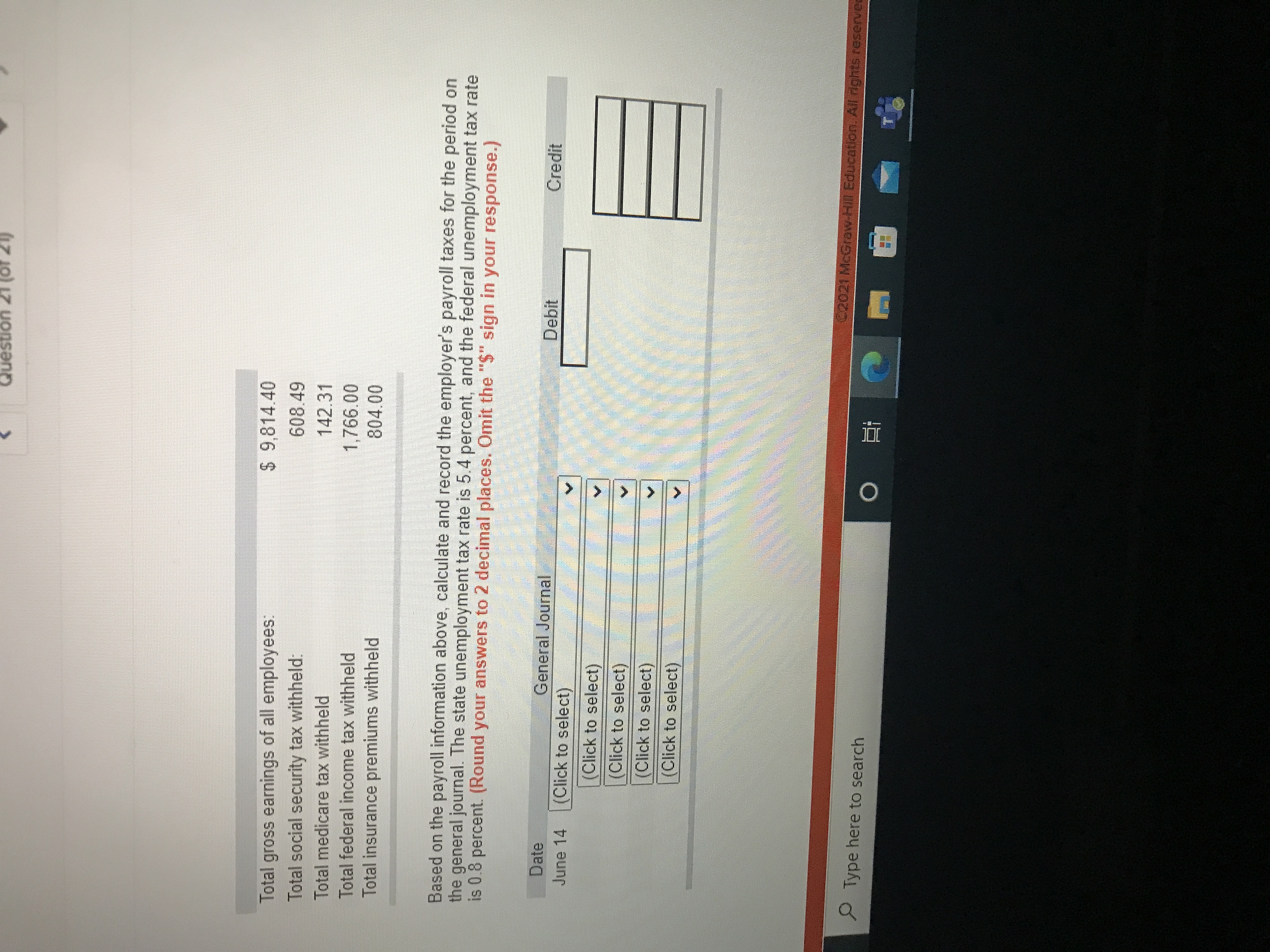

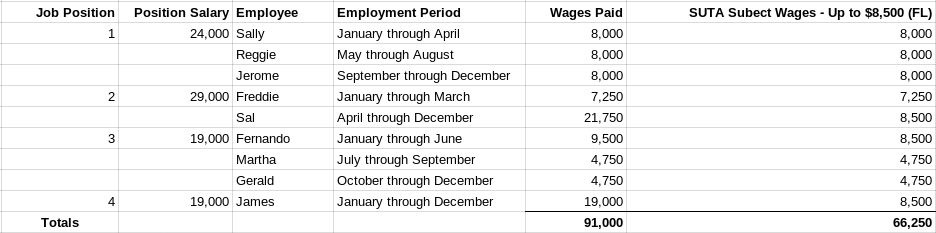

The states SUTA wage base is 7000 per employee. The SUTA tax is a type of payroll tax deducted from paychecks and remitted to the government. It is a payroll tax that goes towards the state unemployment fund.

0010 10 or 700 per. The tax rates are updated periodically and might increase for businesses in certain industries that have higher rates of turnover. General employers are liable if they have had a quarterly payroll of 1500.

The SUTA tax was established. Pennsylvania unemployment insurance tax rates usually range from just over 2 to about 105. Employers are liable for unemployment tax in Virginia if they are currently liable for Federal Unemployment Tax.

Lets say your business is in New York where the lowest SUTA tax rate for 2021 was 2025 and the highest was 9825 and youre assigned a rate of 4025. The minimum and maximum tax rates for wages paid in 2022 are as follows based on annual wages up to 7000 per employee. On an annual basis the department and IRS conduct a cross match to ensure that employers are paying both taxes.

Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. A new employer will usually start at 375 except construction industry. New Hampshire has raised its unemployment tax rates for the second quarter of 2020.

No guidance yet. Employers may make a voluntary. You should be aware of current rates and understand how the tax is calculated.

Unemployment Insurance Tax Rate Tables. You can get tax rate information and a detailed listing of the individuals making up the three-year total of benefit chargebacks used in your Benefit Ratio online or by phone fax. Provided the state does not have any outstanding Title XII.

The State Unemployment Tax Act commonly referred to as SUTA tax is a state unemployment insurance program requiring employers to pay towards a fund. It is updated periodically and.

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

State Unemployment Insurance Tax Rates Tax Policy Center

What Is The Suta Tax And Why Is It Going Up In 2021 Fourth

Solved 18 The Current Federal Unemployment Toxes Futa Tax Chegg Com

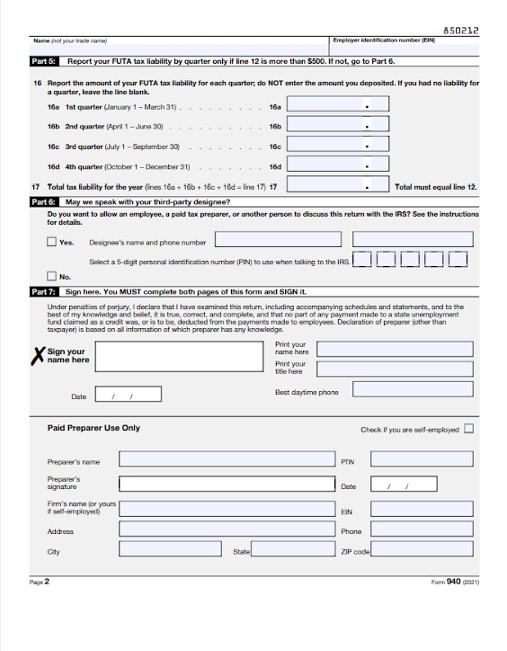

Futa Taxes Form 940 Instructions

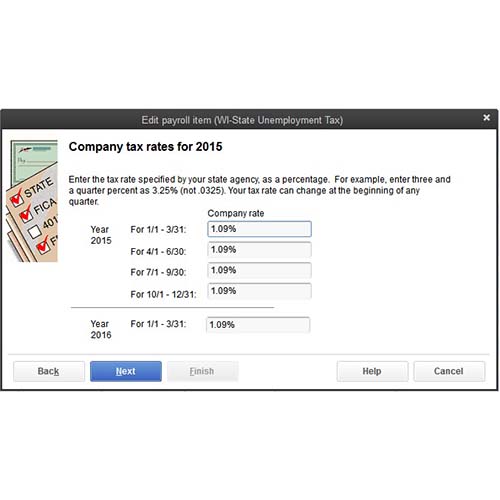

State Unemployment Rate Change And Adjustment For Wisconsin And Minnesota Employers Hawkins Ash Cpas

Fast Unemployment Cost Facts For Washington First Nonprofit Companies

Suta Tax Rate Increase 2020 State By State Gusto

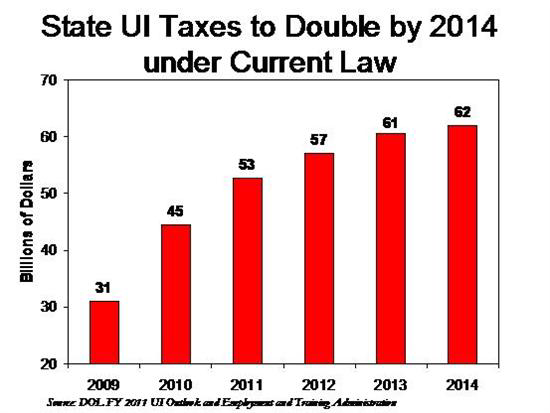

How To Reduce Your Clients Suta Tax Rate In 2014

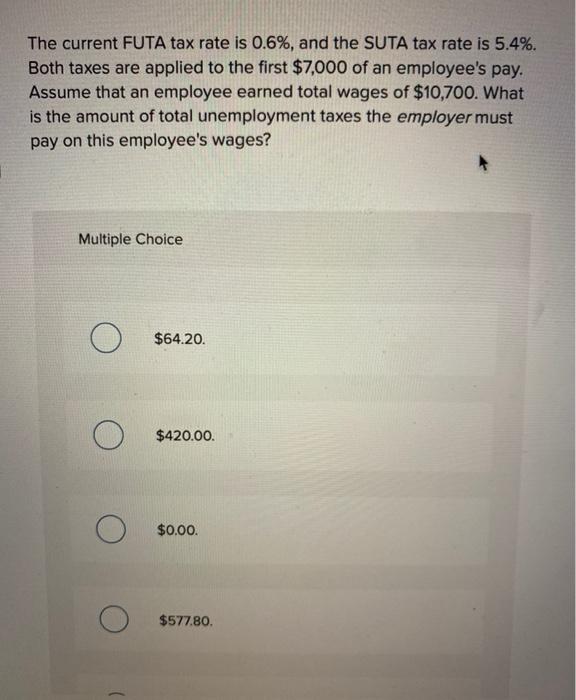

Solved The Current Futa Tax Rate Is 0 6 And The Suta Tax Chegg Com

What Is The Federal Unemployment Tax Rate In 2020

940 Futa Suta Tax Rates For 2022 Form 940 Futa Credit Reduction States

What Is Futa Tax 2021 Tax Rates And Information

Futa Suta Unemployment Tax Rates Procare Support

Unemployment Claims Could Drive Up Taxes For Already Hurting Texas Businesses Keye

Unemployment Tax Rates Employers Unemployment Insurance Minnesota